The health of the construction industry improved further in the second quarter of 2024, building from the stabilisation seen in Q1 to signs of modest growth emerging in the three months April to June, according to the Construction Products Association (CPA).

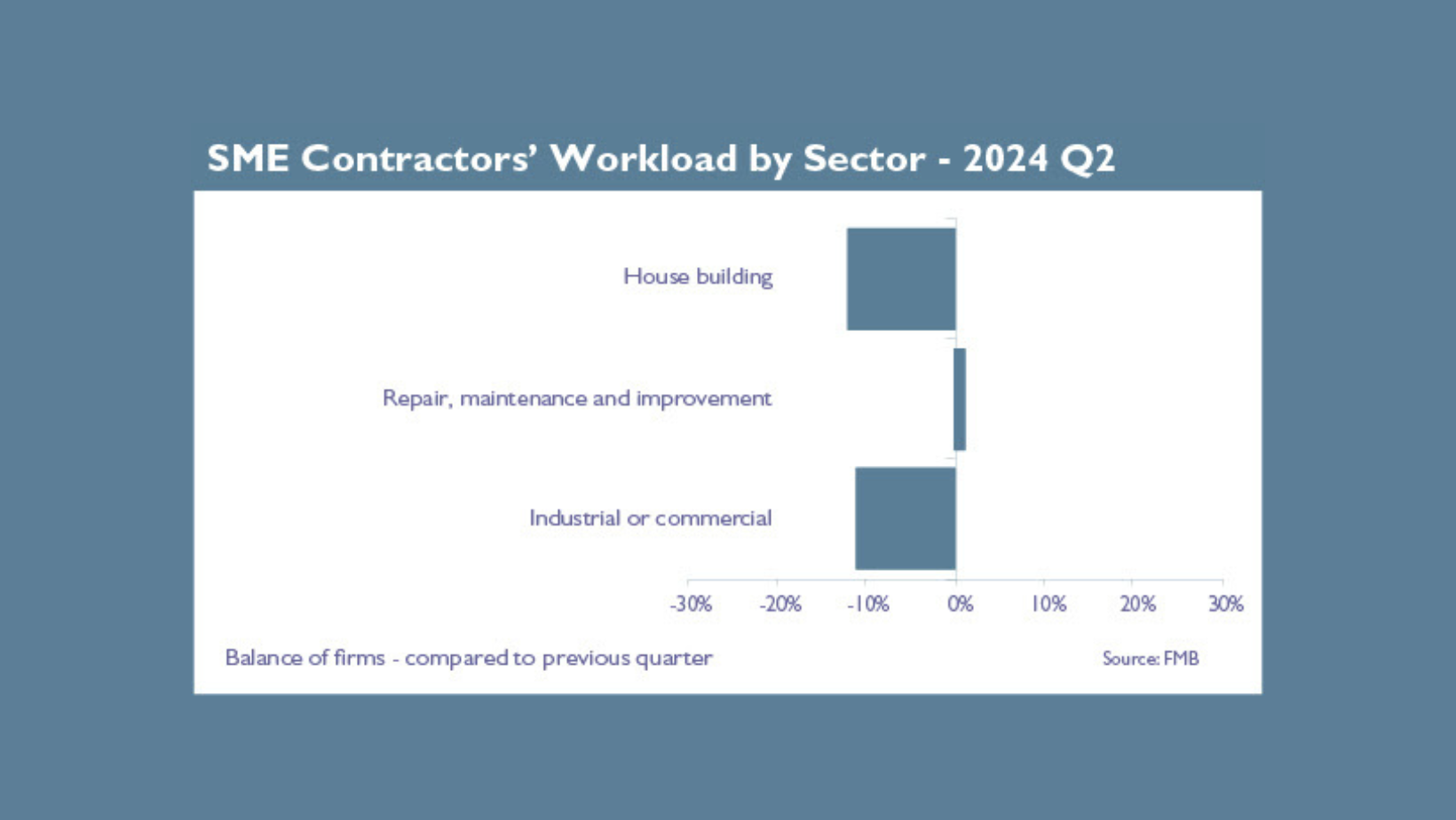

Product manufacturers’ sales increased in the quarter, marking the first rise in two years for heavy side producers, whose products and materials typically feed into the early, structural build phases. SME contractors’ workloads were also reported to have increased, which follows two quarters of decline, albeit driven by a sole sector – repair, maintenance and improvement (RM&I).

Workloads were reported to have still contracted in new build housing and commercial/industrial. Meanwhile, workloads for civil engineering contractors expanded a run of growth to fifteen straight quarters, driven by the activity underway on major infrastructure projects, in the energy sector and on frameworks in regulated sectors such as water & sewerage.

This sectoral split was echoed in chartered surveyors’ workloads in Q2: infrastructure continued to provide activity, whereas workloads were reported lower in housing, commercial and industrial. Underscoring that a pickup in activity is coming off the back of a period of subdued economic growth and strong inflation, with households and businesses also adjusting to an environment of higher interest rates, forward-looking indicators were largely positive, but tentative.

Civil engineering contractors’ order books rose in Q2, along with chartered surveyors and product manufacturers anticipating growth in workloads or sales over the next 12 months.

SME contractors reported that enquiries still decreased in Q2, and in all three main sectors of operation, although the overall net balance was the best in a year.

One key longer-term theme for the construction supply chain was pervasive in all the Q2 surveys: the labour force – whether it be cost pressures from wages and salaries, difficulties in recruiting or employment cuts.